- Ag breakdowns

- Posts

- Is venture capital the best path for innovation in agriculture?

Is venture capital the best path for innovation in agriculture?

Also, innovations in pest and desease control, finance for smallfarms, a new textile derived from potato waste.

“You only live once, but if you do it right, once is enough”

Is Venture Capital the Best Path for Innovation in Agriculture?

Nanocarriers Revolutionize Pest and Disease Control

Innovative finance for smallholders in low-income countries

Innovative fabric made from potato waste

ANALYSIS

Is Venture Capital the Best Path for Innovation in Agriculture?

Summary:

Venture capital has significant limitations in agriculture due to long return periods and few successful acquisitions.

Alternative models like blended capital and startup studios may be better suited to driving innovation in this sector.

Incumbents could play an important role, but they need to adopt a more disruptive, rather than merely iterative, mindset.

As digital agricultural infrastructure matures, the opportunities for returns may improve.

The question of whether venture capital (VC) is the right funding model for agriculture is more relevant than many in the industry might think. It's clear that innovation is key to moving this industry forward. Whether we’re talking about increasing production, reducing environmental impact, or improving farmers' livelihoods, we all agree that we need new technologies to address these issues.

But the big question remains: How do we effectively finance that innovation?

Many argue that venture capital is the natural solution, but I wonder if it’s really the best approach. Agriculture has its own peculiarities that may not fit well with the traditional VC model. Perhaps we need a more nuanced approach.

Is venture capital compatible with agriculture’s timelines?

One argument against VC in agriculture is the issue of timeframes. It is said that venture capital funds do not have the necessary time horizon for agricultural solutions to fully mature.

This is important because, in agriculture, innovations often need years, sometimes decades, to show their impact. However, recent data from CB Insights shows that, on average, even in other sectors funded by VC, it takes a long time to see results. The problem might not be the timeframe itself, but the pressure to grow quickly, sometimes without a solid foundation.

There are cases where agricultural companies that receive venture capital funding lose focus. Instead of consolidating their value proposition, founders are pushed to expand too quickly or spread across too many areas. This often ends poorly, with companies failing to meet expectations and funds not seeing the desired returns.

The structural challenges of the agricultural sector

Another challenge is the structure of the agricultural sector itself. Unlike industries like pharmaceuticals, there aren’t as many large players in agriculture willing to acquire innovative startups. Most large companies in the sector focus on iterative improvements rather than disruption. This means that while new ventures bring bold and promising visions, the market they can target is much smaller.

Additionally, the local nature of many agricultural solutions further complicates scalability. What works in one climate or region may not be applicable in another, reducing the overall value of technological solutions. This is reflected in the relatively low valuations of agtech startups, which limits the number of successful exits for VC funds. In fact, over the past decade, only a handful of companies have achieved large acquisitions or IPOs in this sector, and many of them failed shortly afterward.

Exploring alternatives to venture capital

So, if venture capital isn’t the perfect solution, what options do we have? Some alternatives gaining traction include hybrid capital approaches or venture studio models. For example, the venture studio model builds companies from scratch within the investment firm itself, allowing for more direct control over product development and the team. This is something we’ve already seen in agriculture with initiatives like David Friedberg’s The Production Board.

Another interesting option is blended capital, where traditional investments are combined with concessional loans or philanthropic grants to finance innovations. This approach has the potential to better align investors’ interests with the realities of the agricultural sector, which needs more time for technologies to reach the market and prove their value.

The role of large agricultural companies

Finally, we cannot ignore the role that incumbents, the large companies in the sector, can play. These corporations have the advantage of deep industry knowledge and patient capital. However, while many of them have investment arms focused on startups, their approach is usually more strategic than financial. They look for innovations that complement their current products but are rarely willing to pay the high valuations that VC funds expect.

INDUSTRY

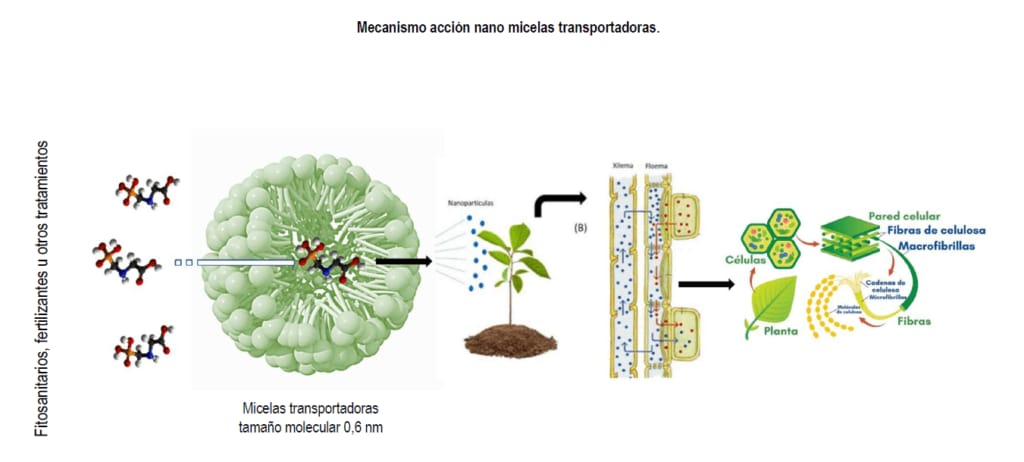

Nanocarriers Revolutionize Pest and Disease Control

Source: IMIDRA – Conclusions on efficiency study for nanocarriers

Nanocarriers, made from biopolymers like lignin and chitosan, are revolutionizing pest and disease control in agriculture. By encapsulating plant extracts in these microscopic capsules, a more efficient application of biological products is achieved, with less waste and no environmental residues. It sounds futuristic, but it's already here, proving its effectiveness in vineyards, sugar beets, and carrots.

The concept is simple: these "nanocarriers" move within the plant, releasing the product exactly where it's needed to fight the pathogen. What’s fascinating is that each nanocarrier is specifically designed for the type of pathogen affecting the crop, allowing for controlled and effective release.

Moreover, this approach is adaptable. Researchers are testing different application methods, from endotherapy (like injecting the product directly into the plant) to drones applying it from the air. It's technology at the service of agriculture!

However, like any technology, there are challenges. Weather conditions, such as storms, can make application difficult. But the potential is enormous: a more sustainable tool with no residues that also reduces the use of commercial pesticides.

Innovative finance for smallholders in low-income countries

Source: Global Agriculture and Food Security Program

A new $75 million investment pilot, launched by the Global Agriculture and Food Security Program (GAFSP), aims to bridge financing gaps for smallholder farmers and MSMEs in low-income countries. According to Felipe Dizon, acting program manager at GAFSP, this initiative seeks to address the lack of access to finance, which has long hindered agricultural development in these regions.

Global hunger remains a critical issue, especially in Africa, where over 280 million people face food insecurity. With only six years left to meet the UN's goal of eradicating hunger by 2030, innovative solutions like GAFSP's Business Investment Financing Track (BIFT) are essential.

BIFT targets 77 countries affected by fragility, conflict, and violence, promoting public-private partnerships and blended finance solutions. By de-risking investments for smallholder farmers and agri-food MSMEs, BIFT enables these groups to scale and access conventional financing. It also supports projects that might not attract commercial funding due to perceived risks but hold high development potential.

The pilot will run through June 2026, and while concerns exist about its transformative impact, Dizon believes BIFT’s innovative approach—focusing on inclusive, climate-smart, and nutritious food systems—could create long-lasting solutions for some of the world’s most vulnerable regions.

Fibe, a British company, has developed an innovative fabric made from potato waste as a green alternative to cotton.

Source: Fibe

This new material, created from leftover potato stems, uses 99.7% less water and produces 82% fewer carbon emissions compared to cotton production.

The process involves collecting discarded potato stems, transforming them into fibers through a special method, and then weaving these fibers into fabric. This approach not only repurposes agricultural waste but could potentially replace up to 70% of the world's cotton demand.

Unlike cotton, which requires significant land and water resources, Fibe's potato-based fabric doesn't need extra farmland and uses a chemical-free, cost-efficient process. This breakthrough could significantly reduce the fashion industry's environmental impact, addressing concerns about cotton's extensive water usage and land requirements.

By turning what was once considered useless debris into a versatile, sustainable textile, Fibe is pioneering a more eco-friendly future for fashion.

Some challenges:

Scalability: It remains to be seen if production can be scaled up to meet global demand.

Performance: The durability, comfort, and versatility of potato-based fabrics compared to traditional textiles need to be thoroughly tested.

Consumer acceptance: Widespread adoption will depend on consumer willingness to embrace new materials.

Industry adaptation: The textile industry would need to adjust its processes and supply chains.

Could potato-based textiles be the future of the textile industry?

ENTERPRISE

John Deere & DeLaval Launch the Milk Sustainability Center (MSC)

With the purpose of Integrating agronomic and animal performance data to optimize nutrient use efficiency and reduce CO2 emissions. Also to help dairy farmers meet sustainability goals while boosting productivity.Advancing Eco Agriculture (AEA) & Topraq Partnership

In Southeast Europe and West/Central Asia, with the purpose of:

- Optimizing water, energy, and fertilizer use through data-driven solutions.

- Integrate Topraq’s precision agriculture tech with AEA’s expertise in plant nutrition and soil health.BioPrime Raises $6M to Scale Sustainable Crop Protection

$6M in Series A funding to expand bio-fungicides, bio-insecticides, and biostimulant technologies.

Targeting expansion in North America, Southeast Asia, and Brazil.Solinftec Seeking to Raise R$300 Million for 17% Equity

Yvy Capital is in talks to invest R$300 million (Brazilian Real, converts to ~$54 million USD) in Solinftec.Agribusiness finance platform Agrolend has raised a $53 million

Series C round, bringing its total funding to nearly $100 million.

Agrolend will use the funds to expand its credit offerings to industries, retailers and cooperatives without increasing its leverage ratio.

WHAT ELSE IS HAPPENING?

Farmers aren’t buying today’s ag robotics model. (Article)

Understanding EPA’s new rules protecting farmworkers from pesticide exposure. (Article)

Hershey invests $500M to improve cocoa farming struggles

21 Laws for life and agronomy (LinkedIn)

Where To Optimize Your ROI In Technology Investments

DJI sued the U.S Defense department for adding the drone maker to a list of companies allegedly working with Beijing’s military.